top of page

Search

Tax Issues to Consider for New Businesses

In spite of COVID-19 restrictions many entrepreneurs are considering possible new or additional business opportunities. So, if you are...

Dec 7, 20207 min read

Renting Your Home or Vacation Home for Short Periods

Many taxpayers rent out their first or second homes without considering tax consequences. Some of these rules can be beneficial, while...

Dec 4, 20203 min read

Preparing for 2021: Tax Planning Strategies for Small Business Owners

If you are a small business owner, every penny of your income counts. This means that you not only want to optimize your revenue, but...

Dec 4, 20207 min read

Year-End Financial Checklist: 4 Money Moves You Should Prioritize Now

If you can’t wait for 2020 to be over, you’re certainly not alone. But don’t let the myriad terrible things about the year distract you...

Dec 3, 20206 min read

Though IRS disallows deductibility of expenses with PPP loan proceeds, they also issue a safe harbor

Previously we shared that the IRS will disallow deductible expenses for businesses with PPP loans and to write your congressional...

Nov 25, 20201 min read

Small business owners influence congressional representatives

With the debate between Congress and IRS continuing, this an opportune time for small business owners to try to influence congressional...

Nov 24, 20201 min read

Congress battles with IRS regarding deductibility of forgiven PPP loans

In response to the IRS ruling on the deductibility of forgiven PPP loans, Congress recently made a joint statement saying the Treasury is...

Nov 23, 20201 min read

IRS doubles down on nondeductibility of PPP-funded expenses

In guidance issued on Wednesday, November 18, IRS reiterated its position that taxpayers cannot claim a deduction for any otherwise...

Nov 22, 20201 min read

Did your earnings suffer in 2020?

Many families have experienced a loss of income in 2020. Here are a few ideas to consider if you are facing an income shortfall this...

Nov 22, 20201 min read

IRS Announces Help with Tax Debt

The IRS recently announced a new program, the Taxpayer Relief Initiative, to help taxpayers who are unable to pay their taxes because of...

Nov 19, 20202 min read

Maximizing Education Credits

An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return. If the credit reduces...

Nov 17, 20201 min read

Reasonable Compensation for Working Shareholders

Are You a Working Shareholder in an S-Corporation? If so, you may not be aware of the IRS’s “reasonable compensation” requirements, which...

Nov 15, 20201 min read

IRS Releases Inflation Adjustments for 2021

At CJ Smith CPA, we want to be forward thinkers and consider planning opportunities for 2021. This article shares IRS inflationary...

Nov 12, 20203 min read

IRS Extends the Opportunity to Defer Capital Gains

As part of tax reform put into place a couple of years ago, individuals are able to defer both short- and long-term capital gains into...

Nov 6, 20203 min read

What Happens if I Missed the October 15th Tax Extension Deadline?

We’ve all been there. Life is super busy. We have to take care of our families and friends, work obligations, and all our other...

Nov 4, 20203 min read

Tax Law Changes Allow Year-End Charitable Planning Opportunities

As the end of the tax year approaches, it is worth spending a few minutes reviewing some of the changes that have been made in the tax...

Nov 2, 20204 min read

Don’t Miss Out on Year-End Tax-Planning Opportunities

2020 has given rise to more than the usual tax-planning opportunities.

Oct 31, 20206 min read

The SBA Issues a Simplified PPP Loan-Forgiveness Application

The whole process of obtaining a PPP loan and applying for forgiveness has been complicated from the start...

Oct 29, 20203 min read

12 Financial Metrics Small Business Owners Should Track

Below you’ll find our list of 12 of the most important elements of your financial report, and what you can do with the information.

Oct 27, 20205 min read

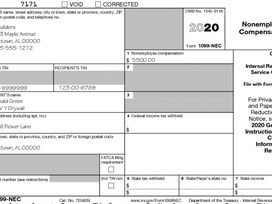

Ready for the 1099-NEC?

The Internal Revenue Service has resurrected a form that has not been used since the early 1980s, Form 1099-NEC.

Oct 24, 20204 min read

bottom of page